what is a deferred tax provision

Around the world governments are stepping in to try and limit the impact of the pandemic by providing financial support in numerous ways from direct cash payments through. Increase the book profit by the amount of deferred tax and its provision or.

Define Deferred Tax Liability Or Asset Accounting Clarified

The deferred income tax is a liability that the company has on its balance sheet but that is not due for payment yet.

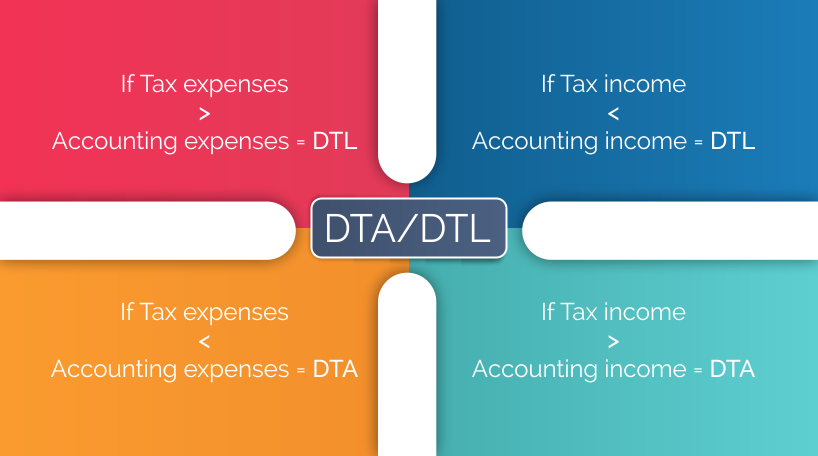

. The term deferred tax in essence refers to the tax which shall either be paid or has already been settled due to transient inconsistency between an organisations income statement and. Deferred tax refers to either a positive asset or negative liability entry on a companys balance sheet regarding tax owed or overpaid due to temporary differences. There are 2 types of timing differences viz.

Putting through a deferred tax charge is a way of evening out these differences so that the company doesnt overestimate its profit. There are two types of deferred tax. Deferred income tax expense.

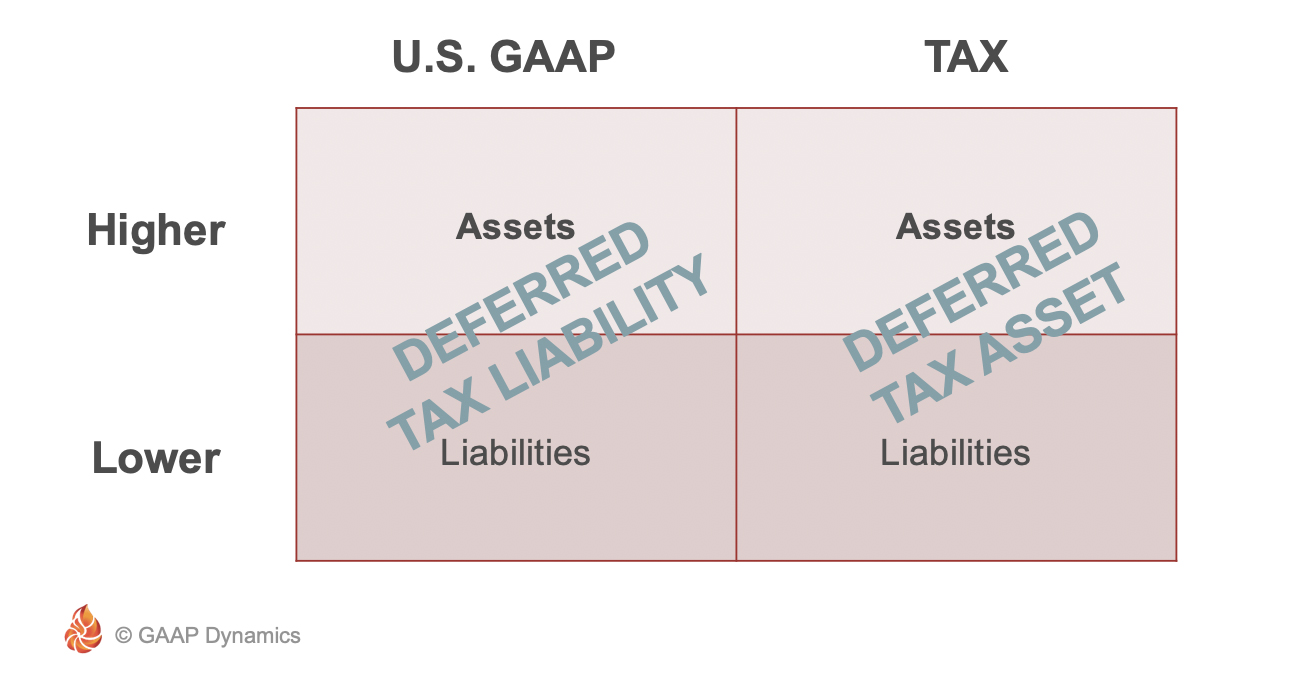

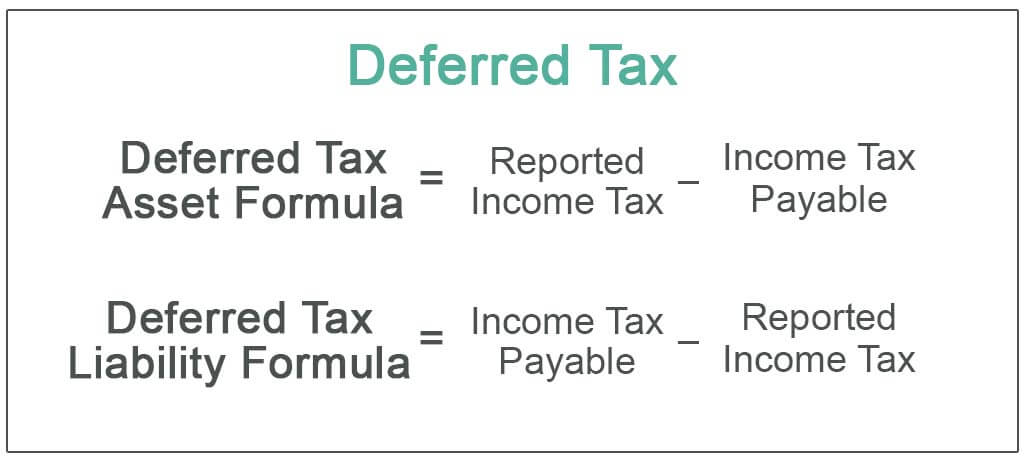

Deferred Tax -Provision for Tax is made for current and deferred taxes. A deferred tax liability is a line item on a balance sheet that indicates that taxes in a certain amount have not been paid but are due in the future. The deferred income tax provision benefit equals the net deferred tax liability asset at the end of the year minus the net deferred tax liability asset at the beginning of the.

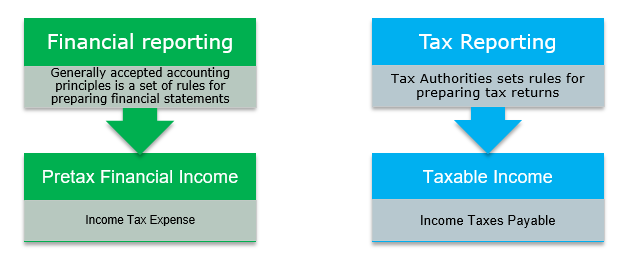

Deferred Income Tax Definition. Deferred tax is the amount of tax payable or recoverable in future reporting periods as a result of transactions or events recognised in current or previous periods accounts. Hire charges for equipment and rental for premises are treated as operating lease and charged to revenue110 Deferred Tax Provision is made for deferred tax for all timing differences arising between taxable income and accounting income at currently enacted or substantially enacted tax rates.

Deferred income tax is a balance sheet item that can either be a liability or an asset as it is a difference resulting from the recognition of income between the. A deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the companys accounting methods. More Deferred Income Tax.

The deferred income tax expense calculates the sum total of the temporary differences and applies the federal corporate tax rate to the resulting amount. Decrease the book profit by the amount of deferred tax if at all such an amount appears on. The double entry to establish the liability is debit tax expense 6000 and credit.

Deferred Tax refer to tax effect in your Balance sheet due to timing differences in recognizing income. A provision is created when deferred tax is charged to. A deferred tax liability is a line item on a balance sheet that indicates that taxes in a certain amount have not been paid but are due in the future.

Such taxes are recorded as an asset on the balance. The deferred tax provision at the end of year 1 should be 80000- 50000 x 20 6000. A deferred tax asset is an asset to the Company that usually arises when the Company has overpaid taxes or paid advance tax.

A deferred tax is recorded in the balance sheet of a company if there are chances of a.

Deferred Tax Liabilities Meaning Example How To Calculate

Deferred Tax Liabilities Meaning Example How To Calculate

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Taxes Modeling Accounting Concept

Net Operating Losses Deferred Tax Assets Tutorial

Deferred Tax Double Entry Bookkeeping

2022 Cfa Level I Exam Cfa Study Preparation

What Is Deferred Tax Asset And Deferred Tax Liability Dta Dtl Taxadda

Deferred Tax Meaning Expense Examples Calculation

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Deferred Tax Liabilities Meaning Example How To Calculate

Deferred Tax Asset Journal Entry How To Recognize

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)